-

Our solutions

- Our clients

With 300 clients and 60,000 users spread across 60 countries around the world, Murex has a truly international client base of capital markets participants.

view all case studies- Insights

- Who we are

Our awards highlight a strong level of customer satisfaction and acknowledge our market expertise.

Visit our awards webpage- Our partners

- Careers

Investment Banks can Seize CBDC, Digital Asset Opportunities with the Right Tech

This blog post is written by Léandre Moreno, head of data and position data management at Murex.

The race to explore Central Bank Digital Currencies is heating up worldwide, signaling a shift in the future of finance.

This is driven by regulatory incentives and traditional finance system actors: a response to demand for secure, efficient and transparent systems built on advanced digital technologies.

As the landscape of digital finance evolves, CBDCs present unique opportunities—and challenges—for financial institutions.

This is particularly the case for investment banks. They are pivotal intermediaries in financial markets, well-positioned to harness innovations CBDCs bring to wholesale banking and retail payments. Murex has worked with clients to enable such actors to deeply engage with digital assets and CBDCs by leveraging the MX.3 platform.

Wholesale CBDCs (wCBDCs) enable investment banks to manage large-scale and cross-border payments efficiently. These transactions, supported by Distributed Ledger Technology (DLT), deliver enhanced security, transparency and T+0 settlement capabilities, ensuring real-time processing.

Central banks worldwide are developing infrastructures to support the issuance, transfer and redemption of wCBDCs. These platforms also integrate advanced features, such as programmable transactions enabled by tokenization and interoperability with existing financial market infrastructures.

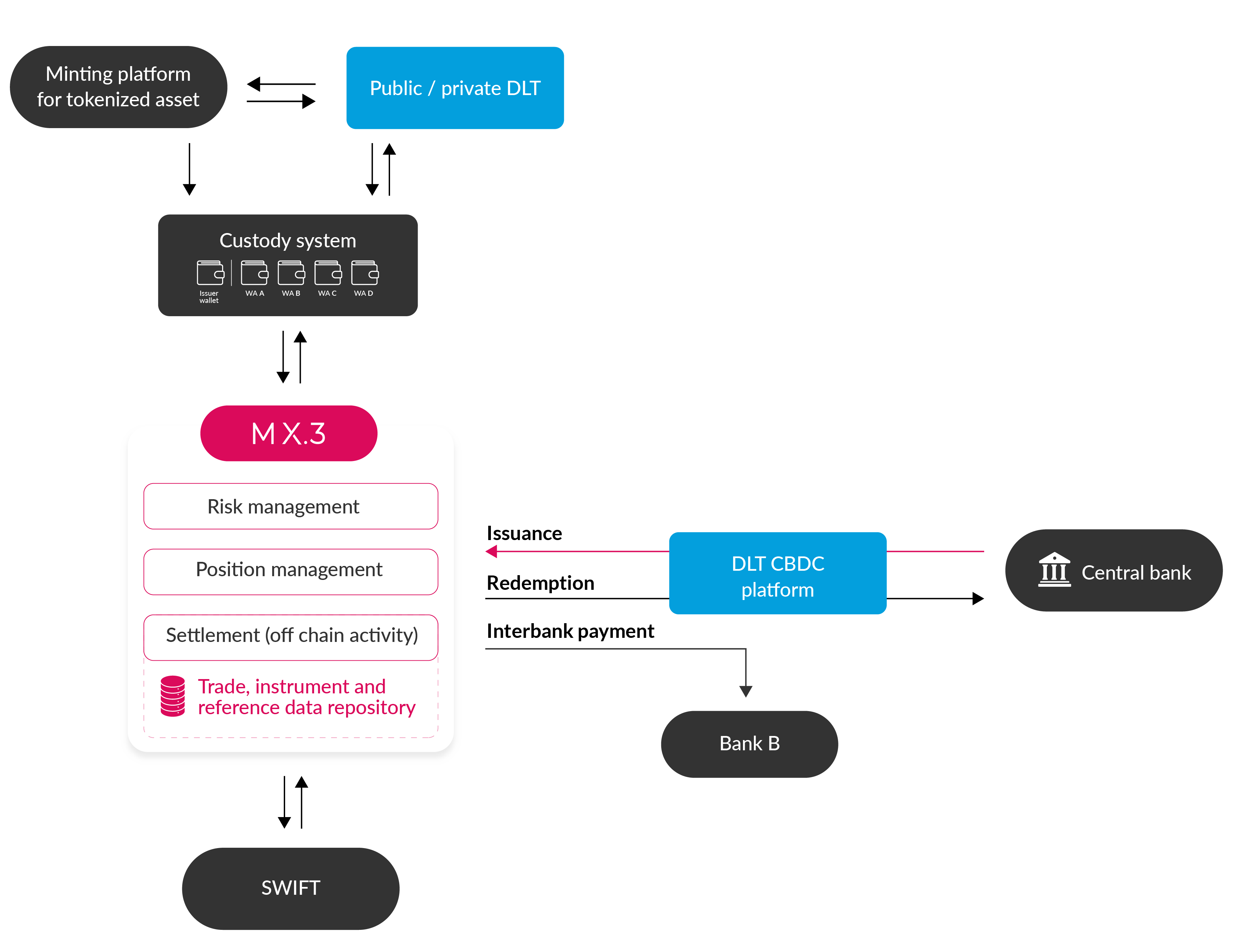

Despite their transformative potential, digital assets based on DLT must integrate seamlessly into banks' IT ecosystems. This integration becomes particularly critical for tokenized assets, which often have counterparts in traditional financial market infrastructures. Systems must be equipped to represent these assets in digital and traditional formats while accommodating dedicated digital asset information from DLT infrastructures.

Murex’s digital asset solutions extend beyond cryptocurrency—spot and derivatives—to address a broader range of digital asset use cases. MX.3 has successfully implemented full integration and interoperability with private DLT systems, enabling seamless management of issuance, transfers and redemption of wCBDCs. By monitoring both fiat and digital cash across its platform, Murex provides a unified view of asset locations, incorporating the nuances of DLT-enabled data and operations.

Murex has also conducted successful experiments with digital bond issuance and other tokenized assets. These include deposit tokens and smart contracts that replicate traditional OTC payoffs within DLT environments. Leveraging its comprehensive payoff catalog and digital asset module, MX.3 orchestrates these use cases effectively—whether they involve fiat currency, wCBDC, settlement tokens or cryptocurrencies.

The digital asset module and post-trade management features within MX.3 seamlessly integrate new asset types with existing IT ecosystems. By orchestrating both on-chain and off-chain activities, MX.3 bridges internal IT infrastructure, financial market systems and innovative DLT utilities.

With its ability to facilitate integration across public and private DLT frameworks, Murex continues to empower investment banks to navigate the complexities of the digital finance era while maintaining operational efficiency and innovation.

Learn more about MX.3 for Digital Assets Trading.

You might be interested in ...

- Our clients